August 2025

Beyond the Bottom Line: Navigating the Province of B.C.’s Audited Financial Statements

623 Fort Street

Victoria, B.C.

V8W 1G1

The Honourable Raj Chouhan

Speaker of the Legislative Assembly

Province of British Columbia

Parliament Buildings

Victoria, British Columbia

V8V 1X4

Dear Mr. Speaker:

I have the pleasure of submitting the report, Beyond the Bottom Line: Navigating the Province of

B.C.’s Audited Financial Statements.

Sheila Dodds, CPA, CA, CIA

Acting Auditor General of British Columbia

Victoria, B.C.

August 2025

Report at a glance

Why we did this report

- Annual financial reporting provides the foundation for the transparent, accountable use of public funds.

- Financial statements aren’t the most user-friendly documents and they can be challenging for readers who are unfamiliar with accounting practices.

- This report can assist readers of the Province of B.C.’s current and future financial statements. It includes resources to help readers:

- understand how the Province manages public funds;

- unlock the wealth of information in financial statements;

- assess how actual financial results compare to budgeted amounts; and

- determine the reliability of financial statements.

- The Office of the Auditor General audits the Province’s Summary Financial Statements and provides assurance on their reliability.

What’s in this report

The Province’s financial reporting framework is explained in this report, as is the importance of the audited Summary Financial Statements. The report uses B.C.’s 2023/24 Public Accounts as reference.

The three chapters provide:

- an overview of the Province’s financial planning and reporting framework, roles and responsibilities, and related legislation;

- a guide to understanding the Province’s financial statements; and

- insight into the value of our audit and what it means for the reliability of the Summary Financial Statements.

Introduction

The Public Accounts are a key element of the Province of B.C.’s annual financial reporting that support transparency and accountability for the use of public funds. While they include a great deal of information on government’s financial activities for the year, including the Province’s annual financial statements, they aren’t the most user-friendly documents.

This report serves as a navigation tool for legislators and members of the public who have an interest in reviewing the Province’s financial statements to understand how money is managed on behalf of taxpayers – and how actual results compare to expenditures approved by the Legislative Assembly.

It’s also important for people to have confidence in the reliability of the financial statements. To that end, the Auditor General is required by provincial law to audit the financial statements and report to the Legislative Assembly on whether the financial statements are fairly presented.

In August 2024, the Province of B.C. published the Public Accounts for the fiscal year that ended on March 31, 2024. Using those documents as reference, this report provides a general overview of the Province’s financial reporting and the importance of the audited Summary Financial Statements. There are three chapters:

- Chapter 1 looks at government’s financial planning and reporting framework, legislated roles and responsibilities, and key dates in the fiscal cycle.

- Chapter 2 helps readers navigate the Province’s annual Summary Financial Statements to assess its financial health.

- Chapter 3 explains the value of our audit of the Summary Financial Statements.

Chapter 1

The Province of B.C.’s Financial Planning and Reporting Framework

Introduction

The Province of B.C.’s financial planning and reporting framework includes legislation, policies, and activities necessary to support the effective stewardship of public funds.

The legislation is foundational and establishes the distinct roles and responsibilities of the Comptroller General, the Minister of Finance, the Auditor General, and the Legislative Assembly:

- The Constitution Act (s.47) establishes the fundamental principle that all expenditures and taxes within the Province’s jurisdiction must be authorized by the Legislative Assembly.

- The Financial Administration Act (FAA) establishes the primary authorities and responsibilities for the control and management of government’s financial affairs. The FAA defines the consolidated revenue fund (CRF) for central government. All public money

other than trust funds must be paid into the CRF and no payment can be made out of the

CRF without an appropriation. - The Budget Transparency and Accountability Act (BTAA) supports accountability, requiring ministries and government organizations to have three-year service plans and annual service plan reports with performance targets and measures. It also governs the content and presentation of the Estimates (planned expenditures) and the Public Accounts (reported financial results for the fiscal year). The BTAA defines the government reporting entity (GRE) as: the government as reported through the consolidated revenue fund, government corporations, and education and health sector organizations.

- The Supply Act establishes the authorization for the government to spend money as voted on by the Legislative Assembly.

- The Auditor General Act establishes the Auditor General as an officer of the Legislature appointed as the auditor of the government reporting entity. One key responsibility of the Auditor General is to audit the government’s annual Summary Financial Statements and report to the Legislative Assembly.

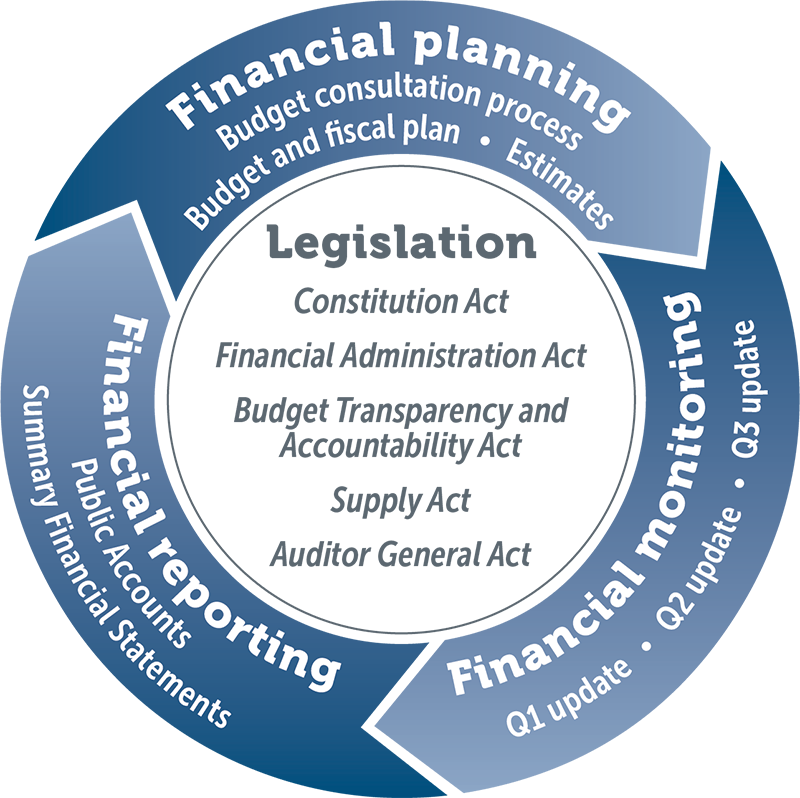

B.C.’s financial planning and reporting framework includes:

- financial planning (budget process and budget approval);

- financial monitoring (quarterly updates on financial results and forecasts to year-end); and

- financial reporting (Public Accounts, including the audited Summary Financial Statements).

Figure: Financial Planning and Reporting Framework

Financial planning – provincial budget

The Budget Transparency and Accountability Act establishes the requirements and responsibilities for the Province’s budget planning process, specifically: the budget consultation process, the budget and fiscal plan, and the Estimates.

By Sept. 15 each year, the Minister of Finance is required to prepare a budget consultation paper that includes a fiscal forecast for the upcoming fiscal year. The budget consultation paper is referred to a legislative committee that must carry out a budget consultation process on behalf of the Legislative Assembly.

The Minister of Finance is also required to prepare and present the government’s budget and fiscal plan (the budget) to the Legislative Assembly each year. The three-year plan includes a budget for the upcoming year, forecasts for the following two years, and an updated forecast for the current period. It also includes government’s assessment of the expected economic conditions, and forecasted revenues, expenses, capital spending, and debt for the next three years.

The act establishes requirements and responsibilities for preparing and presenting the budget. The budget, and the supporting Estimates, are prepared by the Ministry of Finance. The Minister of Finance must present the budget and the Estimates to the Legislative Assembly by the fourth Tuesday of February.

The Estimates provide a detailed breakdown of expected spending by the Government Reporting Entity, which includes central government (e.g., ministries), Crown corporations, universities, colleges, school districts, health authorities and similar government organizations controlled by, or accountable to, the provincial government. For central government, the Estimates form the basis for the annual appropriations approved by the Legislative Assembly for operating and financing transactions.

The Constitution Act requires that the Legislative Assembly authorize all public expenditures and taxes. The approval process starts with the budget. When the Minister of Finance presents the budget, a motion is moved to appoint a Committee of Supply. The committee (including all MLAs except the Speaker) is responsible for examining, debating, and approving the expenditures in the Estimates.

The Committee of Supply’s Estimates debate is a rigorous public process where MLAs question government officials about their plans and intended use of the proposed budget. Planned expenditures are presented as a series of proposed appropriations, by numbered votes corresponding to the spending areas within the various ministries and government agencies. At the conclusion of this process, a Supply Act is adopted by the Legislative Assembly.

The Financial Administration Act mandates that no payment of public funds may be made out of the consolidated revenue fund without the authority of an appropriation. The final supply bill, under the Supply Act, provides the Legislative Assembly’s authorization of the voted appropriations, as approved by the Committee of Supply.

Annual provincial budget cycle

- A budget consultation paper is to be published by the Minister of Finance by Sept. 15, and referred to a legislative committee to carry out budget consultations in the province.

- The budget, fiscal plan, and Estimates need to be delivered to the Legislative Assembly by the fourth Tuesday of February.

- The Legislative Assembly’s Committee of Supply debates and conducts separate votes on expenditures in the Estimates.

- The Supply Act is adopted by the Legislative Assembly, authorizing central government spending for purposes stated in the Estimates.

The Minister of Finance published the 2024 Budget Consultation Paper on Sept. 18, 2023. The Select Standing Committee on Finance and Government Services carried out the budget consultation process in the fall of 2023.

The provincial budget and fiscal plan for 2023/24, and the supporting Estimates, were delivered to the Legislative Assembly on Feb. 28, 2023. The resulting supply bill, authorizing the voted appropriations for 2023/24, was approved on May 11, 2023. The Estimates for fiscal 2023/24 were approved by the Committee of Supply through 54 separate votes. The vote descriptions provide the framework for legislative control of government spending, as the Financial Administration Act specifies that funds can only be expended for the purposes stated in the Estimates.

Financial monitoring – quarterly financial updates

The Budget Transparency and Accountability Act requires government to prepare and publish quarterly updates on the financial spending of the government reporting entity.

The act defines the content that must be included and the date by which they must be published. The reports provide an update on the government’s fiscal situation, including spending to date compared to the approved budget, and forecasted revenues and spending to the end of the fiscal year.

The reports must be made public by the Minister of Finance. Quarterly reports are not audited.

Annual timeline: quarterly financial reports

- The First Quarterly Financial Report for the first three months of the fiscal year is due by Sept. 15.

- The Second Quarterly Financial Report for the first six months of the fiscal year is due by Nov. 30.

- The Third Quarterly Financial Report for the first nine months of the fiscal year is due by Feb. 28.

Financial reporting – Public Accounts and Summary Financial Statements

The Public Accounts are a fundamental component of the Province’s financial reporting. They support transparency and accountability for the use of public funds.

The Public Accounts include annual financial statements and other information that provide a comprehensive overview of government’s financial activities for the fiscal year. They’re essentially a public record of the Province’s revenues (e.g., from taxes, transfers and fees) and expenditures (e.g., program, service, and capital spending) for the year.

The Public Accounts include audited Summary Financial Statements that compare actual results to the approved budget for the government reporting entity.

The Financial Administration Act sets out responsibilities for preparing the Public Accounts and the Summary Financial Statements. It specifies that the Comptroller General prepares the Public Accounts and any other financial statements and reports required by the Minister of Finance. The act also states that: “by August 31 of each year, the Comptroller General must deliver to the Treasury Board and to the Auditor General a summary statement respecting the previous year.”

The Budget Transparency and Accountability Act prescribes the content of the Public Accounts, including:

- financial statements for the government reporting entity;

- supplementary debt schedules;

- supplementary schedules for the consolidated revenue fund;

- a summary of accounting policies; and

- the independent report of the Auditor General on the Summary Financial Statements.

The Budget Transparency and Accountability Act requires the Public Accounts to be made public by the Minister of Finance by August 31 of the following fiscal year. If the Legislative Assembly is in session, the Public Accounts will be tabled in the House. Otherwise, they are filed with the Clerk of the Legislative Assembly. The 2023/24 Public Accounts were filed with the Clerk of the Legislative Assembly and released on Aug. 22, 2024.

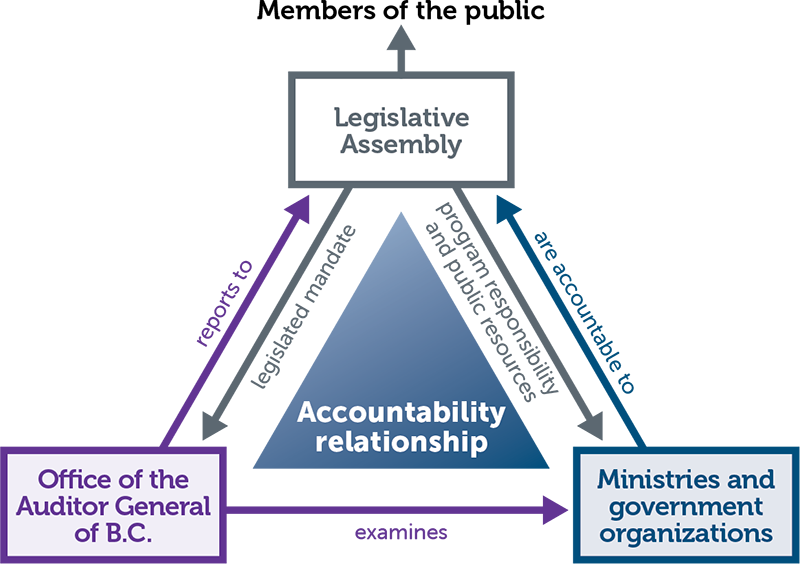

Audit, accountability, and legislative oversight of financial reporting

The Auditor General Act appoints the Auditor General as the auditor of the government reporting entity. This means that the Auditor General is the Legislative Assembly’s independent auditor – accountable and reporting to the Legislative Assembly.

Figure: The accountability relationship

The Auditor General Act requires the Auditor General to report annually to the Legislative Assembly on the financial statements of the government reporting entity. The audit is performed to provide the Legislative Assembly with assurance regarding the reliability of the Province’s Summary Financial Statements. The independent auditor’s report on the Province’s Summary Financial Statements is prepared for the Legislative Assembly and published by the Minister of Finance in the Public Accounts.

The Auditor General is also mandated to report to the Legislative Assembly one or more times each fiscal year on the work undertaken by their office, including performance audit and information reports. Each report is deposited with the Speaker, tabled in the House by the Speaker, and referred to the Select Standing Committee on Public Accounts for consideration.

The Auditor General’s independent audit report on the government’s Summary Financial Statements is addressed to the Legislative Assembly. However, it is not deposited with the Speaker for tabling in the House and it is not referred to the Select Standing Committee on Public Accounts. As required by the Budget Transparency and Accountability Act, the Auditor General’s report is included in the Public Accounts, which are tabled by the Minister of Finance.

The Office of the Auditor General has reported to the Legislative Assembly with highlights of its audit of the province’s financial statements since the office was established, starting with the financial statements for the year ended March 31, 1978.

Chapter 2

Understanding Financial Reporting

Introduction

The Summary Financial Statements compile and present the consolidated financial results of all ministries and government-controlled organizations. Audited annual financial statements provide essential financial data for decision making within government and by external stakeholders. Understanding of the Province of B.C.’s financial health helps to inform budgeting, resource allocation, investment strategies, and debt management.

Audited financial information, such as the Summary Financial Statements, supports accountability and ensures the accuracy and reliability of financial data. When the Province seeks to raise capital by issuing bonds, audited financial information helps external investors and lenders assess the Province’s financial credibility and influences their decisions on providing funding.

However, government economic activities are highly complex, involving a wide range of operations, diverse revenue sources, and the allocation of public funds across multiple projects and programs. The resulting financial statements can be complex.

This chapter looks at how financial information is interconnected throughout the financial statements and related notes. Readers may find it helpful to have a copy of the 2023/24 Public Accounts on hand as they review this chapter.

Think of financial statements as health trackers. Just as health trackers monitor physical well-being, financial statements show the financial well-being of an organization. The next few sections discuss key financial statements and what they reveal about financial health.

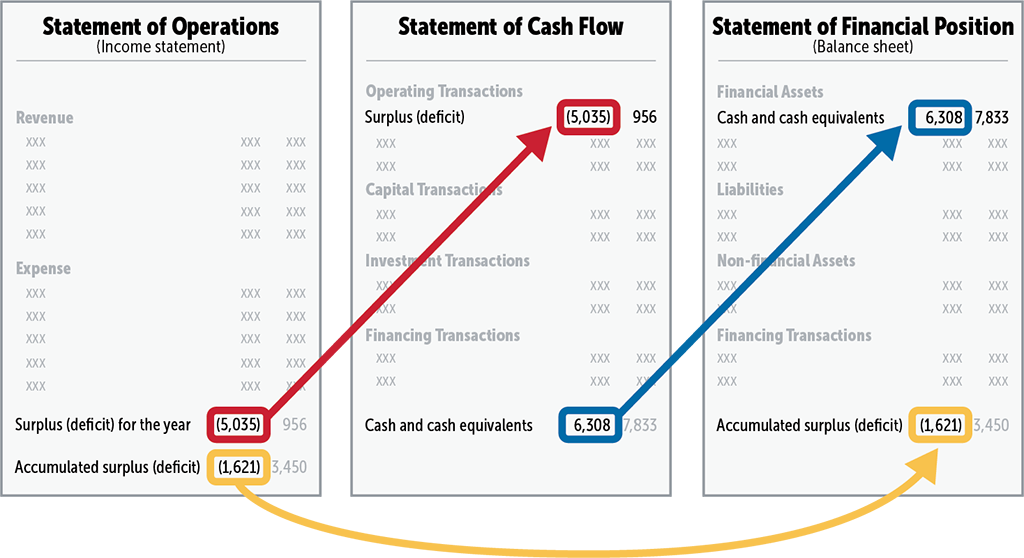

Figure: Relationship between the three financial statements

Consolidated Statement of Operations

The Consolidated Statement of Operations is like a sleep tracker for finances. Revenue represents hours of sleep. Expenses represent waking hours. When revenue exceeds expenses, you have a surplus and are well-rested. But if expenses outpace revenue, a deficit occurs, leaving you tired.

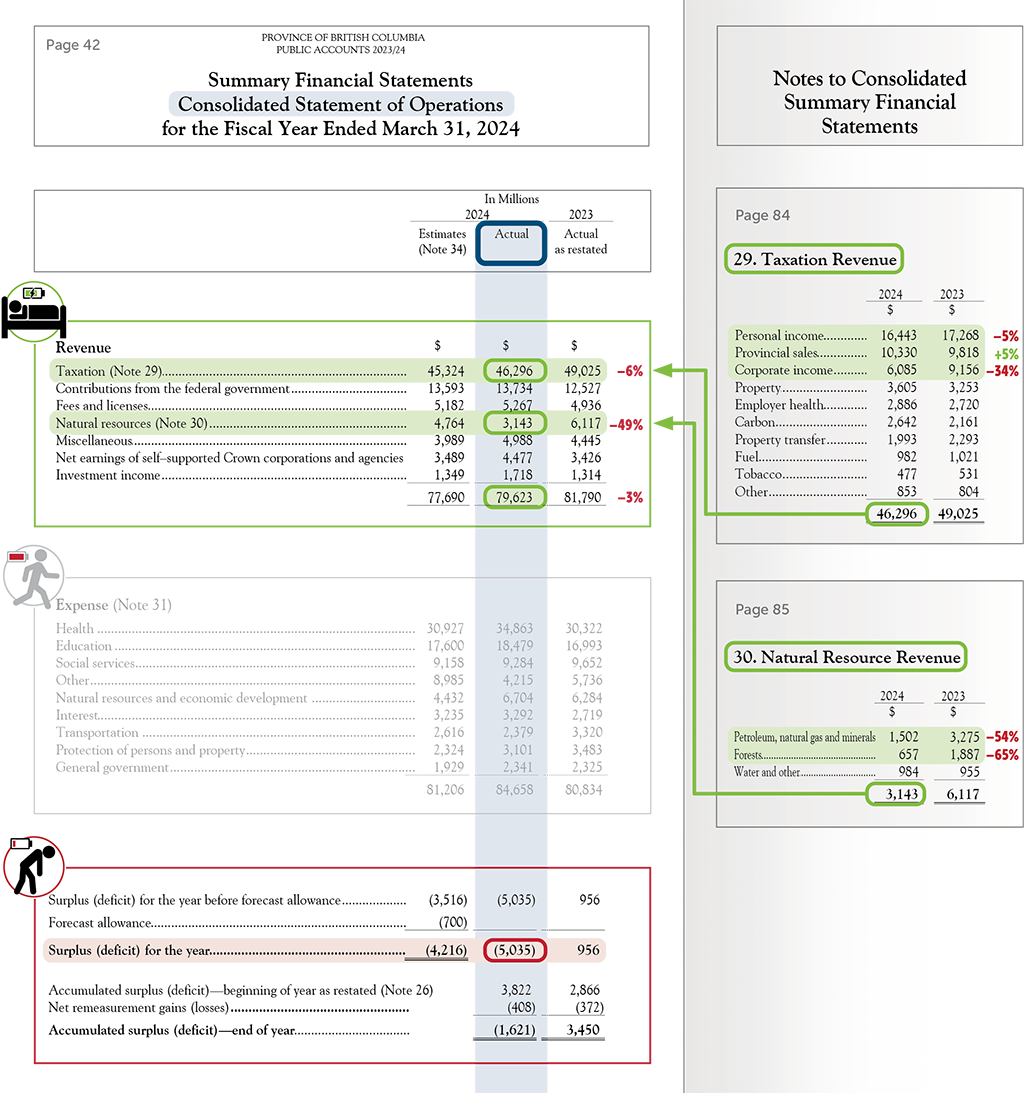

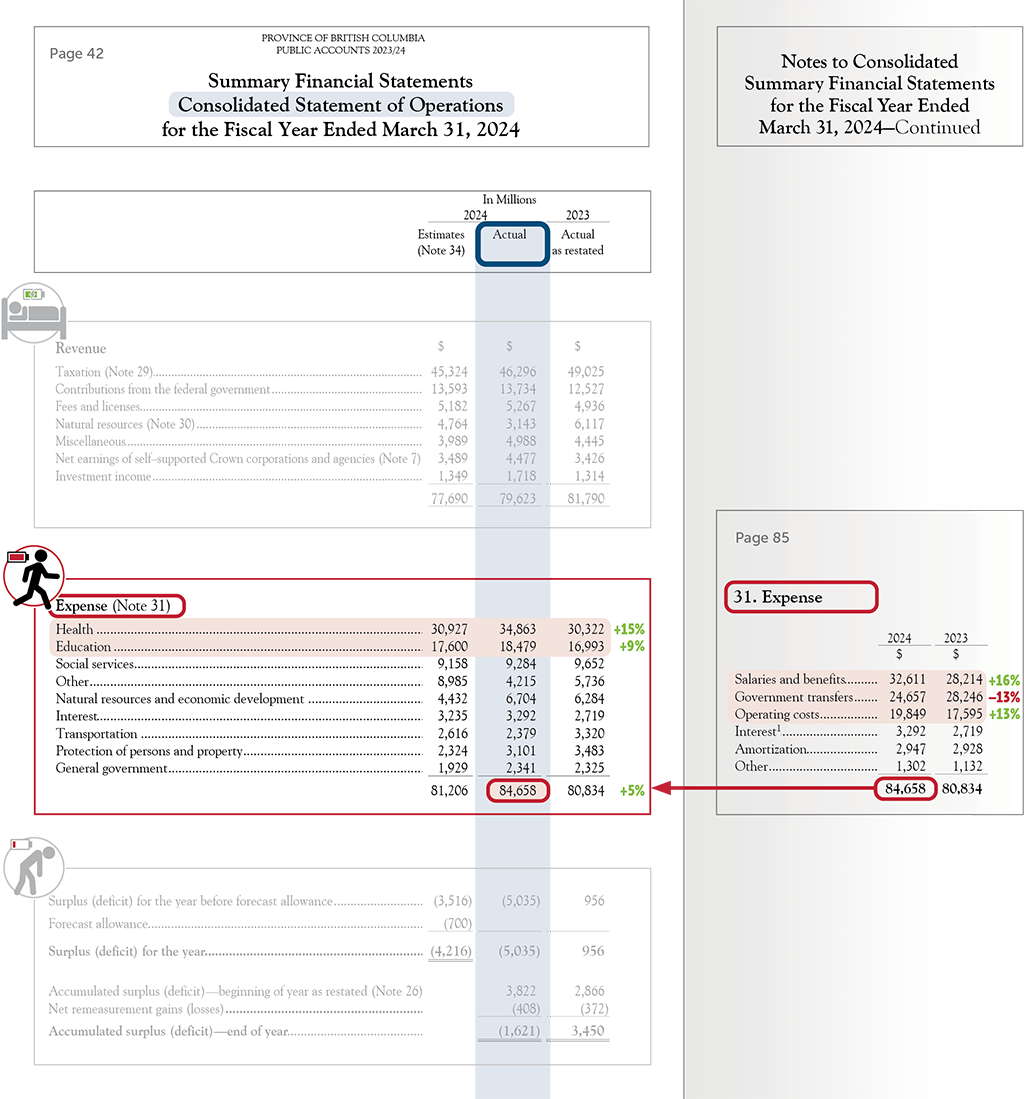

In fiscal year 2023/24 (FY24), the Province of B.C. reported a deficit of $5 billion in its Consolidated Statement of Operations. This statement provides information on the current year budget, current year actuals, prior year actuals, and references to additional information in the related notes to the financial statements.

Here are some take-aways from the Consolidated Statement of Operations:

- The $5-billion deficit in FY24 was 19% higher than the budgeted deficit of $4.2 billion. In the prior year, the province had a $956-million surplus.

- In FY24, total revenue was 3% lower than FY23 but 2% higher than budgeted. The net change reflected a mix of increases and decreases. In particular, tax revenue, the Province’s largest revenue source (58% of the total) fell 6% from the previous year but was 2% higher than the budgeted amount. Natural resource revenue showed the most significant change, with a 49% decrease compared to the prior year and 34% lower than budget.

- To find more information on tax revenues, go to Note 29 – Taxation Revenue (page 84). It shows a 5% decrease in personal income tax and a 5% increase in provincial sales tax compared to the prior year. The most significant change was in corporate income tax, down 34% compared to FY23.

- Note 30 – Natural Resource Revenue (page 85) reveals that petroleum and natural gas revenue dropped by 54% and forest revenue fell 65%. The note also shows how various costs and programs affected total natural resource revenue.

- In FY24, total expenses increased by 5% compared to FY23 and by 4% over budget (page 42). Health-related expenses were 41% of the total, followed by education at 22%. Health expenses in FY24 were 15% higher than the previous year and 13% higher than the budgeted amount, while education expenses were 9% above last year’s figures and 5% more than budgeted.

- Note 31 – Expense (page 85) categorizes the same expenses by type, showing the funds used on specific activities or purposes. Salaries and benefits were 39% of the total. Government transfers (funds given by the Province to individuals, organizations, or other governments without expecting goods, services, repayment, or financial return) were 29%, and operating expenses were 23%.

- Compared to the prior year, salaries and benefits rose 16%, while operating expenses increased 13%. In contrast, government transfers decreased 13%.

Consolidated Statement of Cash Flow

The Statement of Cash Flow is like a hydration tracker. If you drink more water than you sweat out, you’ll be hydrated, or “liquid.” If you lose more water than you take in, you’ll become dehydrated, which may signal a potential “liquidity risk.” The cash flow statement categorizes cash flows into operating, capital, investing, and financing activities.

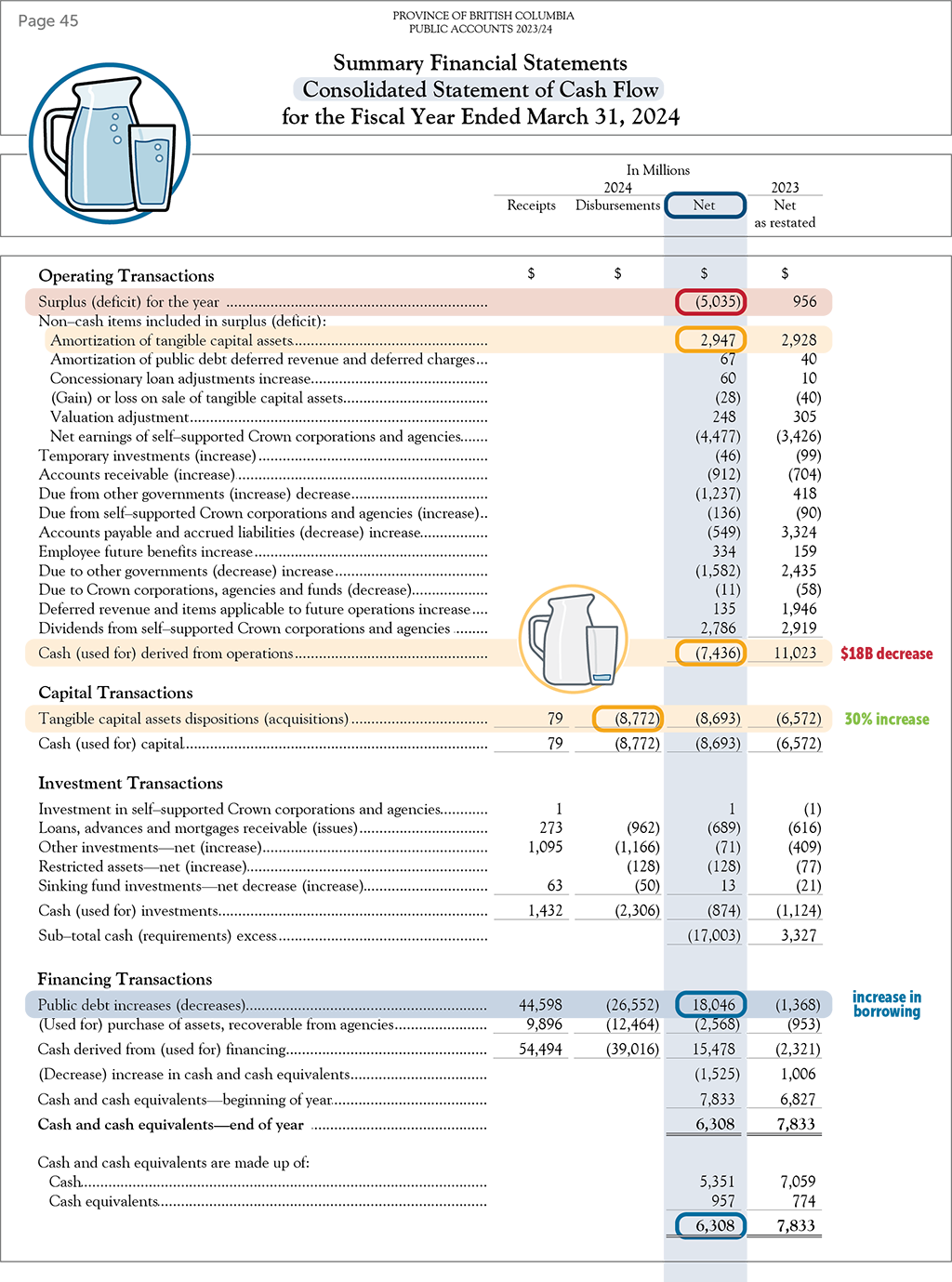

The Cash Flow Statement shows the movement of cash during the fiscal year. The bottom line reflects the net cash balance at fiscal year-end. On March 31, 2024, the Province’s cash balance was $6.3 billion. The difference between the current year and the prior year is typically due to factors such as the timing of cash inflows and outflows, changes in investment and financing strategies, and significant operational shifts.

Here are some take-aways from the Statement of Cash Flow:

- The net of all cash inflows and outflows specifically for annual operations shifted $18 billion, from generating $11 billion in cash in FY23 to using $7.4 billion in cash in FY24.

- Government’s reporting of cash flows from operating transactions begins with the surplus or deficit from the Statement of Operations (page 42), which was $5 billion (as discussed in the previous section).

- The surplus or deficit is then adjusted for any non-cash items. For example, amortization is added back because it’s not actual cash spent. Amortization is an accounting method used to reflect the cost of long-term assets over time. Another example would be accruals for amounts owing but not yet paid.

- Cash flows arising from operating activities is a key indicator as to whether government’s operations are funded and the extent to which sufficient cash flows have been generated to sustain government’s operations, repay loans, and make new investments without having to borrow.

- Capital transactions focus exclusively on cash flows associated with the purchase or disposal of capital assets. Cash used for the purchase and construction of tangible capital assets increased by 30% compared to the prior year.

- FY24 capital transactions saw a net cash outflow of $8.7 billion, with $8.8 billion spent to acquire capital assets. Details on the $8.8 billion in capital asset additions are in the Consolidated Statement of Tangible Capital Assets (page 106). Readers can also find details in this note about the amortization expense that was previously mentioned.

- The other categories in the Statement of Cash Flow focus on cash movements related to investments and debt activities. Under public debt increases (decreases), there’s a significant shift. In FY23, the Province experienced a $1.4 billion cash outflow, indicating more debt was repaid than borrowed. In contrast, FY24 saw an $18 billion cash inflow, indicating that more debt was issued than repaid. This trend is consistent with other sections of the financial statements, where a significant rise in borrowing was noted for FY24.

Consolidated Statement of Financial Position

The Statement of Financial Position provides a snapshot of the Province’s overall financial health at a specific point in time. It shows assets (comparable to healthy habits like regular exercise and a balanced diet) and liabilities (e.g., unhealthy habits like junk food consumption).

When liabilities (bad habits) outweigh assets (healthy habits), you likely will gain some financial weight and have some health concerns. When the Province is in a net liability position, it tells us that the Province borrowed to finance its assets and will need to use future revenues to repay those liabilities.

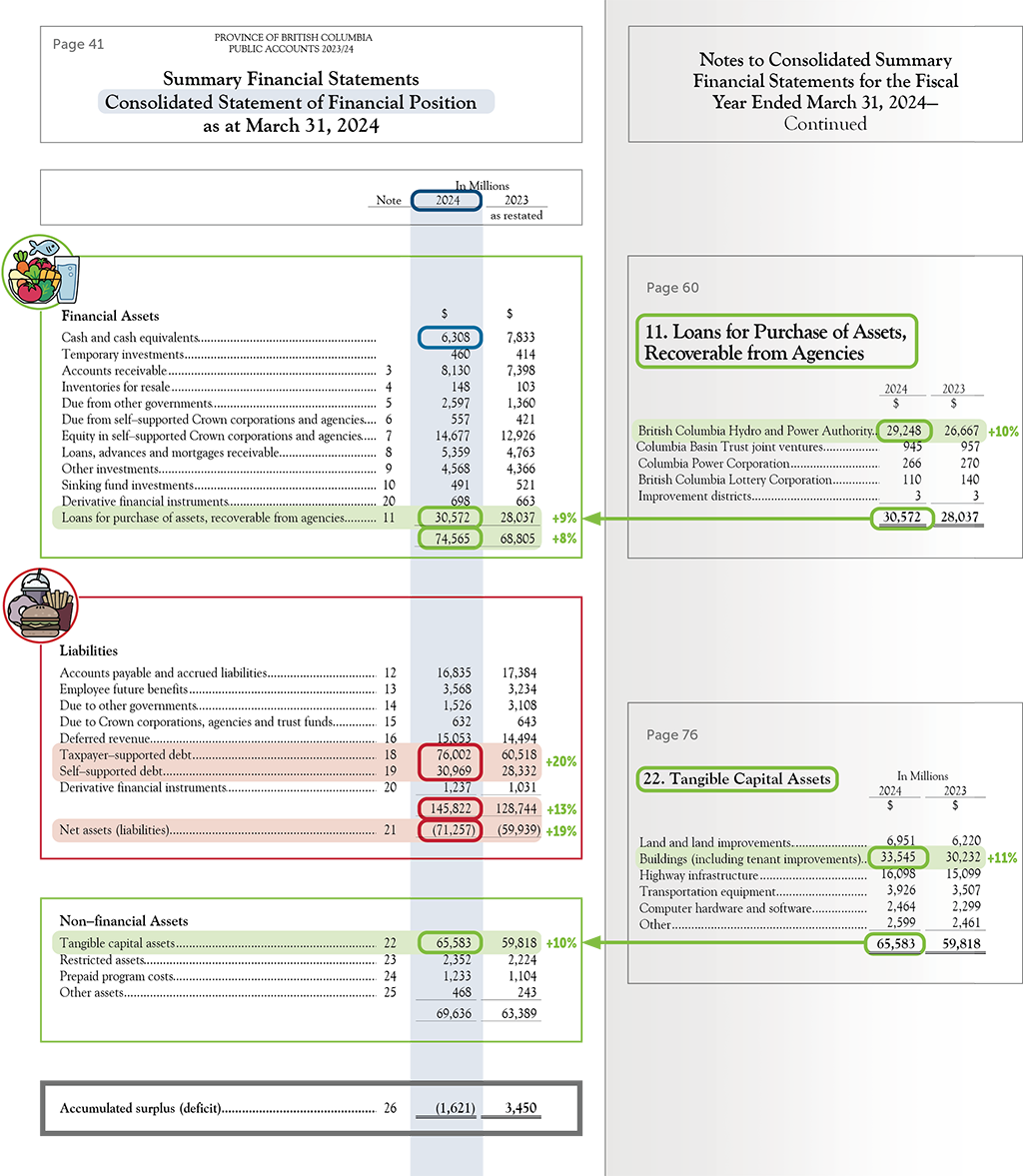

In FY24, the Province reported net liabilities of $71 billion, reflecting a 19% increase from the previous year. While total financial assets rose by 8%, total liabilities grew by 13% from FY23.

Here are take-aways from the Statement of Financial Position:

- The Province lends money to government business enterprises for the purchase of capital assets and expects them to repay the loans. Government business enterprises are government-run organizations that operate independently, sell goods and services to the public, and earn enough revenue to maintain their operations and cover their liabilities without needing additional revenue from government transfers.

- Loans recoverable from government business enterprises made up 41% of total financial assets in FY24, reflecting a 9% increase from the previous year.

- Note 11 – Loans for Purchase of Assets, Recoverable from Agencies (page 60) outlines loans recoverable from various government business enterprises. We can see that BC Hydro and Power Authority accounted for 96% of the total loan receivable balance, with their balance increasing by 10% compared to the prior year.

- Tangible capital assets represent one of the most significant balances on this statement. In FY24, it increased by 10%, from $60 billion to $66 billion.

- Note 22 – Tangible Capital Assets (page 76) breaks down the various categories of capital assets, showing that buildings accounted for 51% of the total and grew by 11% from FY23. The Consolidated Statement of Tangible Capital Assets (page 106) offers further details on the movement of capital assets, including additions, disposals, and amortization.

- Debt, which is 73% of the total liabilities, increased by 20% compared to FY23.

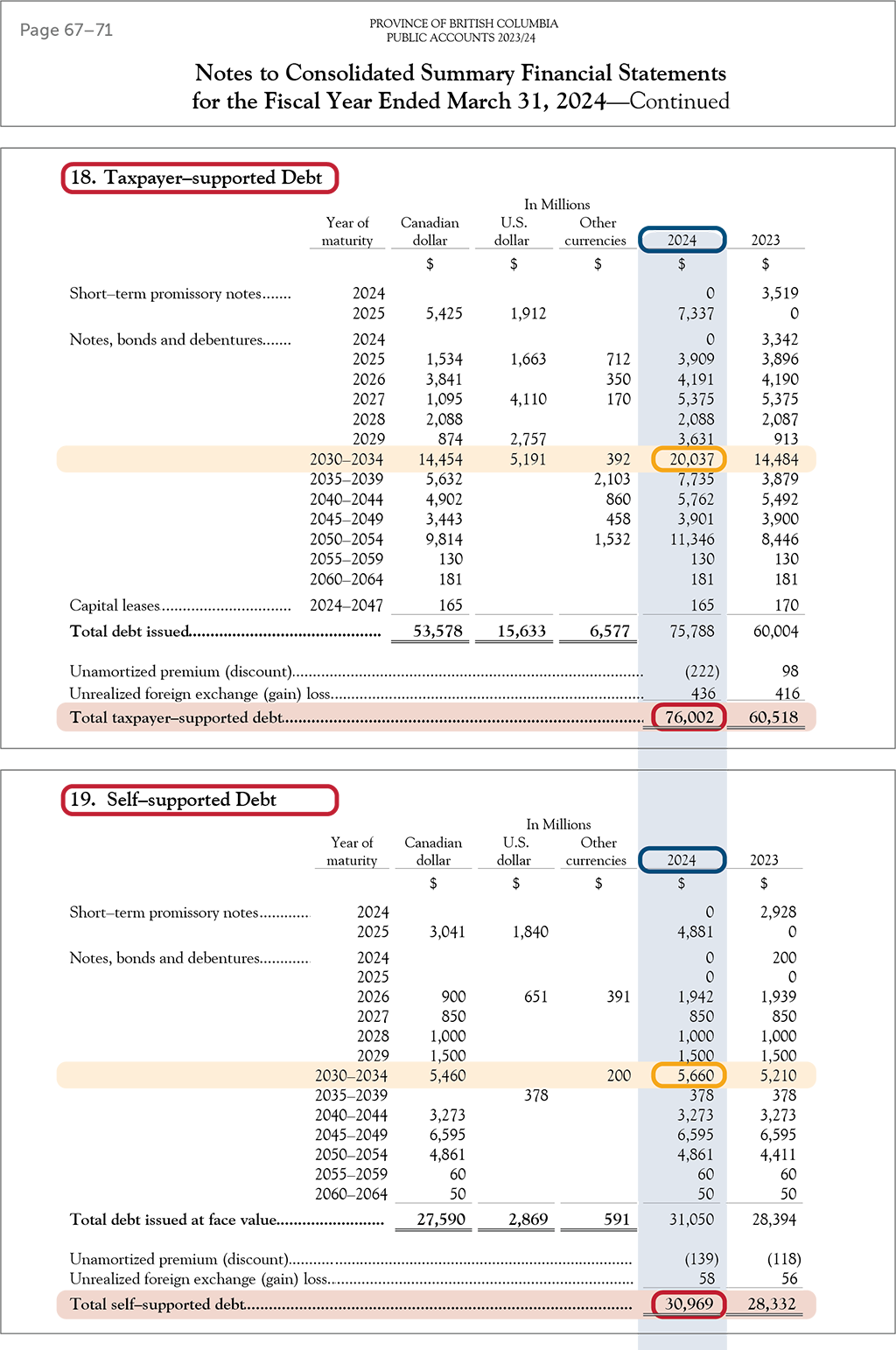

- Note 18 – Taxpayer Supported Debt and Note 19 – Self-supported Debt (pages 67–71) provide further details on the Province’s debt:

- Debt composition across various currencies highlight the associated foreign exchange risk.

- In FY24, 76% of the total debt was in Canadian dollars, with the remaining 24% in foreign currencies. This represents a shift from FY23, where 82% of the debt was in Canadian dollars and 18% was in foreign currencies. A higher proportion of borrowing in foreign currencies increases exposure to fluctuations in exchange rates.

- The “year of maturity” highlights the impact on both short-term and long-term cash needs for debt repayment. Note 18 shows a significant portion of the debt is set to mature between 2030 and 2034.

- To mitigate risks associated with borrowing, such as foreign exchange and interest rate fluctuations, the Province uses derivative instruments. These instruments are highly complex and may be of particular interest to advanced users.

- Without going into their specifics here, Note 20 – Risk Management and Derivative Financial Instruments (pages 71–75) in the audited financial statements offers detailed information on the risks and how government manages them.

Other financial statement information

In addition to the primary statements discussed above, the financial statements include other information of interest. Here’s a high-level summary and how the information may be used.

- Statement of Remeasurement Gains and Losses (page 44). This statement reports gains and losses that have not yet been realized. Investment values can shift with market movements before they are sold. During this period, any changes in value are considered “unrealized” gains or losses, meaning they do not impact the bottom line. Once the investments are sold, these amounts become “realized” gains or losses and are reflected in the Statement of Operations, affecting revenue and expenses. In FY24, there were $206 million in net unrealized losses and $109 million in net realized gains.

- Statement of Change in Net Liabilities (page 43). This statement explains the difference between the surplus or deficit from operations and the change in net financial assets (or net liabilities) for the period. It offers important accountability information, serving as a key indicator of whether the entity may be taking on unsustainable levels of debt.

- Note 1 Significant Accounting Policies (pages 47-53). This note acts as the foundational guide for understanding how the financial statements are prepared. It outlines the accounting policies and principles the Province follows when compiling its financial information. These policies are critical because they ensure consistency, transparency, and accuracy in reporting. By providing clear guidelines for how transactions and events are recognized, measured, and presented, this note helps users interpret the financial statements correctly.

- Note 2 Measurement Uncertainty (pages 53-54). Some figures in the financial statements are based on estimates using the best available information at the time. Examples include accrual of tax revenues, pension obligations, and environmental liabilities. Measurement uncertainty arises mainly due to timing, as exact amounts can only be determined in the future. This note explains these estimates and provides a range of possible values to show the potential impact of over or underestimating the amounts. It helps users understand the risks associated with potential variability in the financial information and assess the reliability of the reported figures.

- Many other notes in the financial statements provide valuable information. Some may address significant events specific to the current year, such as major policy changes. Others may reveal the ongoing financial impact of a significant event from the past, such as Covid-19. Additionally, subsequent event notes are crucial to understanding major developments that occurred after the fiscal year end. Even if these events don’t directly alter the current financial statements, they provide insight into significant potential future impacts.

Audited financial statements, while interconnected and complex, do offer a wealth of valuable information. They can give readers a more complete, accurate picture of the Province’s financial health. By doing so, they support informed decision making.

Unaudited information in the public accounts

The public accounts also include other information that isn’t audited:

- Financial Statements Discussion and Analysis Report (pages 11-29) provides an overview and interpretation of financial results.

- Supplementary information (pages 111-117) highlights financial results for Crown corporations, school districts, universities, colleges, and health organizations that are included in the Province’s consolidated Summary Financial Statements.

- Consolidated Revenue Fund Extracts (pages 121-134) display the financial results specifically for core government operations carried out directly by ministries and special offices.

- Provincial Debt Summary (pages 137-150) offers expanded information about the Province’s debt, including trend analysis, cross-jurisdictional comparisons, and key financial ratio assessments. The debt summary table, key indicators, and performance measures are audited, while the broader analysis is unaudited.

Chapter 3

Assurance: The Importance of the Audit

Under the Auditor General Act, the Auditor General is the auditor of the government reporting entity. The Auditor General must report annually to the Legislative Assembly, in accordance with Canadian generally accepted auditing standards, on the Summary Financial Statements (SFS) of the Province of B.C.

The value of the audit

The Office of the Auditor General supports the Legislative Assembly, and specifically the Select Standing Committee on Public Accounts, in holding government accountable for its management and use of public resources. One way it does this is through the annual audit of the SFS.

Chapter 2 describes some of the valuable information contained in the SFS. However, the statements are only of value if the information within them is true and fair. The purpose of our audit is to support an increased level of confidence in the information in the SFS.

Our audit is conducted to provide an independent assessment of whether the SFS are fairly stated. This enhances the credibility of the financial statements, which is important for the various readers who rely on the SFS to make informed decisions.

Members of the Legislative Assembly aren’t the only users of the SFS. Others may include institutional investors, credit rating agencies, other governments, and other interested members of the public. Each user has distinct needs. As auditors it’s our job to consider these factors so that we can design an audit that matches the risk tolerance of the various users, including:

- Taxpayers seeking transparency that their tax dollars are being managed responsibly.

- Credit rating agencies assessing the Province’s financial health to determine creditworthiness.

- Investors evaluating the statements to make informed investing decisions.

- General public relying on the information to understand the Province’s financial results and financial health.

The audit process

We conduct our audit in accordance with the Canadian Auditing Standards. The standards set a risk-based approach, meaning we do more extensive audit procedures – and gather more and better-quality audit evidence – in the areas with the highest risk of being materially misstated.

A risk-based approach

Materiality refers to the significance or value of an omission or misstatement in the financial statements. We ask, how could it influence the decision making of users who rely on financial statements?

The concept of materiality applies to planning and performing the audit. It’s also used to evaluate the effect of identified misstatements on the financial statements. Materiality guides:

- the nature and extent of our audit procedures;

- how we assess the sufficiency of the audit evidence we gather; and

- our evaluation of any misstatements we find during the audit.

Materiality is a matter of professional judgment. It’s influenced by the needs of the users of the financial statements. An error or omission is considered material when it could mislead users of the financial statements.

Under Canadian Auditing Standards, risks of material misstatement due to fraud are automatically considered significant risks. The standards require all auditors to design procedures and gather evidence to address two such fraud-related risks.

The first of these is the risk of fraud resulting from management override of controls. All financial statements have a significant risk of material misstatement because management, through their position and influence, can manipulate financial results. They can influence estimates and accounting policy changes to achieve favourable financial reporting outcomes in the current year or in the future. As auditors we are required to design and carry out tailored procedures and gather evidence to address this risk.

The second is the risk of fraud related to revenue. Revenue accounts are the accounts most commonly affected by internal and external fraud. It’s the responsibility of auditors to remain alert to this significant risk and to carry out procedures to address it.

The areas of audit focus change from year to year depending on economic trends, new accounting standards, the complexity of transactions, and any other factors identified.

One example of an area of audit focus is the consolidation of the SFS. This is due to the complexity in identifying all the organizations in the government reporting entity along with significant judgments required to determine control and the types of government organizations. Both have a pervasive impact on the financial statements.

The complexity of the consolidation process itself also creates a risk of fraud and error. Management may use their influence to override controls and manipulate the consolidation process to achieve favourable financial reporting outcomes. As a result, in our audit we design and carry out tailored procedures to address this risk in the context of the consolidation.

Audit coverage planning

The audit of the SFS is what’s known as a “group audit” under Canadian Auditing Standards. The Auditor General is the “group auditor.” In a group audit, different business units (components) are consolidated into a single set of financial statements known as the group financial statements. Auditors who perform audit work on a component are “component auditors.”

The group auditor establishes the overall audit strategy and plan. As necessary, the group auditor provides direction to component auditors, reviews their work, and evaluates the audit evidence to form an opinion on the group financial statements.

The group financial statements (the SFS) consolidate the financial information of central government and 138 other government organizations, including Crown corporations, universities, colleges, school districts, health authorities, and similar entities controlled by or accountable to the provincial government.

Our Financial Audit Coverage Plan, published annually, outlines which government organizations’ financial statements will be audited by our office directly and which will be audited by component auditors.

Government organizations that aren’t audited by the Office of the Auditor General are primarily audited by large accounting firms. We work with the firms to ensure their work meets our requirements.

Our coordination and communication with component auditors play an important role in informing our risk assessment. We maintain regular contact with accounting firm representatives. Those interactions allow us to share identified risks and plan additional audit work when necessary to address risks affecting the group audit. We issue letters of instruction to all component auditors with directions on information and further audit procedures we require for our group audit. The letters also indicate the timing required for the group audit, which may be slightly different from what they need to do for their individual audits.

Results of the 2023/24 SFS audit

When we identify errors in the financial statements, we bring them to management’s attention and request that they be corrected.

During our 2023/24 audit, five misstatements that we identified were corrected and reflected in the final SFS. The monetary impact of the corrected adjustments was an increase to revenue of $399 million and a decrease to expenses of $34 million, for an annual deficit decrease of $433 million. Additionally, liabilities decreased by $21 million and assets increased by $412 million.

Not all misstatements we identify are corrected. When corrections aren’t made, we assess the cumulative impact of the uncorrected misstatements on the financial statements. If they are material and could affect a user’s ability to rely on the financial statements, we will adjust our auditor’s report to explain the impact.

We report all identified misstatements to the Minister of Finance at the end of the audit and indicate which errors were corrected and which were not.

We also provide ministries and the Office of the Comptroller General with recommendations to improve weaknesses in internal controls and reporting processes identified during the audit. The goal is to help ministries enhance their financial reporting and internal control environment.

When misstatements that are material to the financial statements are not corrected, we are required under Canadian Auditing Standards to qualify our audit report. The existence of qualifications in the independent auditor’s report may reduce user’s confidence in the accuracy of the financial statements.

Our audit identified two such material errors (set out as qualifications in our independent auditor’s report) which were not corrected by government. They relate to deferral of revenues and the incomplete disclosure of contractual obligations.

Deferral of revenues

Our audit identified a material misstatement related to government’s accounting treatment for government transfers originally received for restricted purposes, for example federal funds received for building a hospital.

These funds are recorded as liabilities when they are first received, because government has a responsibility to spend the funds for a restricted purpose. We found government has not been extinguishing these liabilities when the funds have been used for the intended purpose and no further obligations exist. Government’s accounting does not conform with current Canadian generally accepted accounting principles for senior governments, as stated in the Public Sector Accounting Standards.

Our audits have reported this type of misstatement since the inception of the public sector accounting standard for government transfers, which applies to periods beginning on or after April 1, 2012. As a result, the magnitude of this misstatement has grown over time. As of March 31, 2024, liabilities were overstated by $7.67 billion. Contributions from the federal government, recorded as revenues for the year ended March 31, 2024, were understated by $702 million and the accumulated deficit was overstated by $6.97 billion.

Incomplete contractual obligations disclosure

Under Canadian generally accepted accounting principles, contractual obligations that commit the government to certain expenditures for a considerable period into the future must be disclosed in the financial statements. An example would be multi-year contracts for the delivery of services or the construction of assets. This is so financial statement users will be able to understand the nature and extent to which the government’s resources are already committed in future years.

Government makes such disclosures in Note 28 – Contingent Liabilities and Contractual Obligations. However, our audit identified contracts that weren’t included in the disclosures. The magnitude of the omissions resulted in a material misstatement. The following table outlines the estimated effect of this misstatement on Note 28 in the financial statements.

| Understatement of contractual obligations | 2025 $ | 2026 $ | 2027 $ | 2028 $ | 2029 $ | 2030 and beyond $ | Total $ |

| Consolidated Revenue Fund and Taxpayer-supported Crown corporations and agencies (in millions) | 1,284 | 905 | 604 | 504 | 499 | 1,911 | 5,707 |

Summary

The Office of the Auditor General plays a vital role in supporting the Legislative Assembly in holding government accountable for its management and use of public resources.

Through our risk-based approach, we assess the risks of material misstatements, perform extensive audit procedures, and provide an independent auditor’s report concluding on the fair presentation of the Summary Financial Statements. Our audit work and report provide users with assurance that they can rely on the information in the financial statements.

The Province of B.C.’s annual financial statements support transparency and accountability for the use of public funds. While they include a great deal of information on government’s financial activities for the year and on the Province’s financial health, they can be difficult to interpret. This report has been designed to help users understand the Province’s current and future Summary Financial Statements and what they reveal about the Province’s financial health.

Contents

Chapter 1 – The Province of B.C.’s Financial Planning and Reporting Framework

Financial planning – provincial budget

Financial monitoring – quarterly financial updates

Financial reporting – Public Accounts and Summary Financial Statements

Audit, accountability, and legislative oversight of financial reporting

Chapter 2 - Understanding Financial Reporting

Consolidated Statement of Operations

Consolidated Statement of Cash Flow

Consolidated Statement of Financial Position

The Office of the Auditor General acknowledges that we are living and working with gratitude and respect on the traditional territories of the First Nations peoples of British Columbia. We specifically acknowledge that our office is located on the traditional territories of the Lekwungen people of the Songhees and Esquimalt Nations (Victoria).

Information presented here is the intellectual property of the Auditor General of British Columbia and is copyright protected in right of the Crown. We invite readers to reproduce any material, asking only that they credit our office with authorship when any information, results or recommendations are used.